5 Essential Fintech App Features to Improve Your User Experience

In 2022, the fintech market in Australia reached a value of US$ 2.1 Billion. Looking forward, IMARC Group anticipates that the Australian Fintech market will expand dramatically with a projected value of US$ 9.7 Billion by 2028, demonstrating a robust CAGR of 28.3% during the period of 2023-2028.

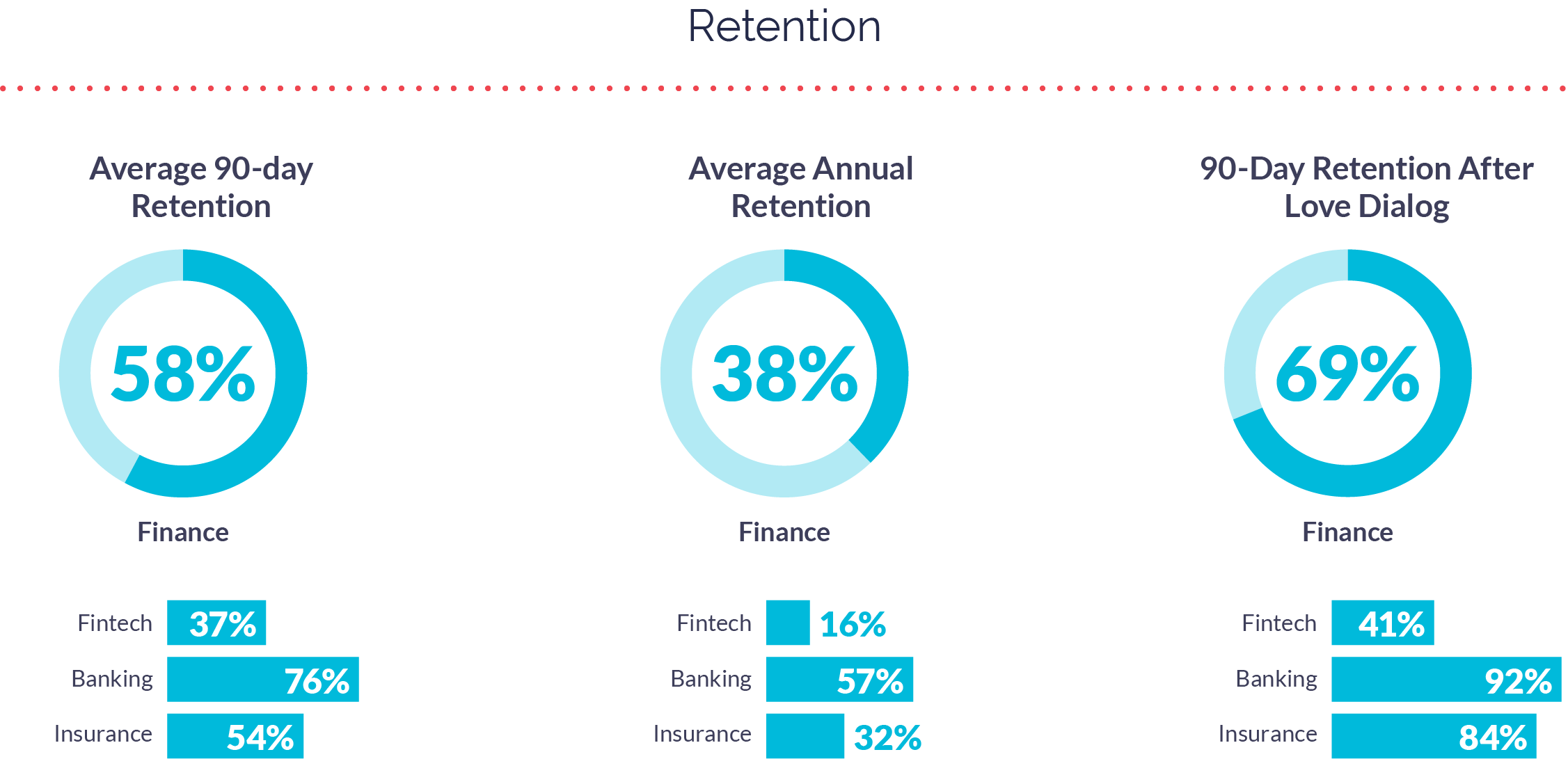

As a result of this significant growth, many corporations have invested in innovative fintech apps, especially in the mobile space. This is because customers are getting more digital-savvy, and the fintech application enjoys exceptionally high rates of user retention compared to other categories. The average retention rate after 90 days stands at an impressive 58% (surpassing the 48% benchmark for different apps), while annual retention rates are 38%.

Given the broad spectrum of fintech apps available, the main factor contributing to retention success comes down to the strategies and features that the top-performing fintech apps utilise. So if you aspire to achieve similar results or raise the bar even higher, this article will analyse some essential fintech app features that add value to your app development strategy.

What Are The Most Popular Types Of Fintech Apps?

Fintech app development offers a unique opportunity for appreneurs and developers to showcase their creativity. With a wide array of existing fintech apps in the market and the promise of new categories emerging in the future, there is ample room for innovation. If you're new to the fintech space and wondering what type of app you should develop, the following considerations may help you make a decision:

- Mobile banking app: This app is probably the most used app since it provides a convenient and secure way for individuals to perform various financial activities without going to branches. Must-have features for mobile banking apps often comprise secure authentication, account management, etc.

- Insurance app: Recent years have witnessed the rise of insure-tech. There are two primary categories to consider: agent-focused apps and customer-focused apps, and each type serves a particular purpose. If you’re looking to develop an outstanding insurance app, here is the 5-step process!

- e-Wallet: Mobile wallet has gained popularity due to their convenience, speed, and enhanced security compared to traditional payment methods. They have become particularly prevalent in the realm of mobile payments, allowing users to make purchases using their smartphones or other mobile devices.

- Trading platform: Advanced trading platforms often provide traders with relevant financial information to assist in making informed trading decisions.

Once the identification of the desired fintech app type has been accomplished, the subsequent step involves defining the key features to be included. By meticulously outlining the essential features, the app can effectively cater to the specific needs of its users while distinguishing itself in the competitive fintech landscape. Here are some ideas about key features to follow.

1. Biometric Authentication

In the realm of fintech, user retention goes beyond mere app engagement and enjoyment. Establishing a strong sense of security is imperative because when users perceive their money to be at risk, they are likely to discontinue app usage.

Biometric authentication emerges as a top-notch strategy for enhancing app security, surpassing conventional authentication methods like passwords. Its inherent superiority lies in the fact that it leverages unique biological traits for identity verification, such as fingerprints, facial features, voice patterns, or iris scans, to offer a highly secure and reliable method of verifying individuals' identities.

According to a Visa survey, 46% of customers expressed their belief that biometrics offers a higher level of security when it comes to accessing their financial information. Its widespread adoption is driven by the inherent difficulty of replicating or spoofing these biological traits, making it significantly more resistant to unauthorised access or identity theft than traditional authentication methods such as passwords or PINs.

Beyond its unparalleled security, from the customer’s perspective, biometric technology also has another advantage besides security: convenience. It provides a seamless and user-friendly experience, eliminating the need to remember complex passwords or carry physical tokens, users just need to open an app and use fingerprints or facial identification.

2. Multiple Payment Gateways

No financial service app can function accurately without having at least one digital payment option. However, as your fintech app matures and attracts a growing customer base, it becomes imperative to enhance the range of payment options available.

Today's users anticipate convenience and flexibility in managing their financial transactions, and providing more payment choices is important in meeting these expectations. By incorporating multiple digital payment options, such as credit and debit cards, mobile wallets, peer-to-peer payments, and cryptocurrency payments, fintech apps can cater to a broader audience with diverse preferences. You can consider integrating with some widely-used payment service providers (PSPs) such as PayPal, Venmo, Cash App, Stripe, Amazon Pay, Apple Pay, Google Play, and Samsung Pay.

This not only improves user experience but also eliminates barriers to entry for potential users who may have specific payment methods they prefer to use. Ultimately, the availability of multiple payment options in a fintech app increases user satisfaction, encourages engagement, and contributes to the app's growth and success.

3. Live Chat and Chatbot

%201.webp?width=1200&height=966&name=22380775_6534541%20(1)%201.webp)

For better and more thorough support, you can consider integrating a customer support feature into your app, such as live chat or chatbot. By incorporating this support feature, your customers can promptly access assistance without the need to wait for a response via email or phone. Through the chat feature, customers can conveniently inquire about various matters, such as financial management, account tracking, financial coaching, and the submission of relevant information.

Westpac's mobile app offers a chatbot feature called "Westpac Live Assist" that provides customers with instant answers to their banking queries, including account balances, transaction history, and account services. They also provide live chat support for additional assistance.

Moreover, by incorporating Generative AI into the chatbot, many banks and financial institutions can address customer queries in real time, monitor common customer concerns, and deliver customized interactions. Recently, Westpac has deepened ties with conversational AI software firm Kasisto to coordinate the various chatbots it uses across its diverse products and divisions.

4. Real-time Notifications and Alerts

Instant notifications and alerts are essential to keep customers informed about account activities, transaction updates, and security events. By promptly notifying users of unusual transactions, low balances, or upcoming bill payments, these alerts enable customers to take immediate action and make informed decisions, ultimately fostering a more secure and satisfactory user experience.

These real-time notifications enable users to promptly detect and address any unauthorized or suspicious transactions, manage their budgets effectively, avoid late fees or penalties, and make informed investment decisions.

Real-time notifications and alerts can include various types of information, such as:

Transaction Notifications: Users receive instant alerts whenever a transaction occurs on their account, including deposits, withdrawals, payments, or transfers. This helps users monitor their financial activities closely and identify any unauthorized or suspicious transactions.

Account Balance Updates: Users can receive real-time updates on their account balance, allowing them to keep track of their available funds and make informed financial decisions.

Payment Reminders: Fintech apps can send timely reminders for upcoming bill payments, loan repayments, or subscription renewals. These reminders help users avoid late fees or penalties and manage their finances effectively.

5. Real-time Analysis and Reports

Fintech apps offer the advantage of utilizing AI to cater to individual needs and make personalized decisions. An appealing feature found in these apps is the real-time dashboard, which empowers users to access up-to-date analytics, visualize trends, and make informed decisions regarding their financial activities.

Real-time analysis involves the continuous monitoring and processing of financial data, allowing users to gain immediate insights into their account balances, transactions, spending patterns, investment performance, and other key financial metrics. By utilizing advanced algorithms and analytics tools, fintech apps can provide users with visual representations such as charts, graphs, and summaries to facilitate a better understanding of their financial status.

Additionally, this data-driven approach helps users evaluate their spending habits, track progress toward financial goals, and make adjustments as needed to achieve desired outcomes. By monitoring transactions, account balances, and financial activity updates in real-time, users can detect anomalies, potential fraud, or market fluctuations, allowing them to take proactive measures to mitigate risks and safeguard their financial well-being.

Fintech App Development Process of KMS Solutions

With domain knowledge in the BFSI sector, we have a proven track record of assisting numerous enterprises in delivering comprehensive financial services solutions, including fundraising platform development, mobile banking MVP releases, PSP integrations, and many more.

We understand the unique challenges and complexities that arise in the BFSI industry, and our team is well-equipped to provide tailored solutions to address specific business requirements. Partner with us to leverage our expertise in the BFSI sector and unlock the full potential of your financial services initiatives!