According to a recent report by the Australian Banking Association (ABA), the financial services sector is experiencing a significant shift in consumer behavior, with nearly 98.9% of financial transactions and interactions now taking place digitally. Additionally, the Australian fintech market is projected to reach a staggering USD 33.99B by 2033, highlighting the industry's relentless drive toward innovation.

To remain competitive and relevant in this rapidly evolving landscape, BFSI businesses have embraced Minimum Viable Products (MVPs), which not only enable them to keep pace with ever-changing customer demands but also minimize development costs and time-to-market. In this article, we will delve into the advantages and key steps to building an MVP in banking and finance.

Benefits of Building an MVP in the Banking and Finance Industry

38% of startups fail because of their limited budget (CBInsights, 2021).

As banks are now competing with nimble tech innovators, they must accelerate tech innovation to survive (PwC, 2021).

The above statistics explicitly highlight the advantages of beginning the new product development journey with an MVP. Nevertheless, there exist additional compelling motives for a BFSI organisation to engage in MVP product development:

- Validate Business Product Ideas: Imagine you launch a new financial product without developing an MVP app, the failed one may cause a significant loss in terms of time, money, and resources. By releasing a simplified version of a new product, banks can quickly gauge customer interest and gather feedback to validate whether their concept resonates with the target audience.

- Place a Low-Risk, Cost-effective Experiment: Developing a fully-featured banking product can be costly and time-consuming. An MVP allows banks to test their innovative ideas in the market with minimal investment. Moreover, BFSI businesses can allocate their budget more efficiently, focusing on core features that provide the most value to customers. If the MVP doesn't perform as expected, the bank can pivot or make adjustments without significant losses.

- Accelerate the Development Process: MVPs enable banks to enter the market sooner. In an industry where speed and agility are increasingly vital, launching a minimum viable version of software allows businesses to respond quickly to changing customer preferences, market dynamics, and regulatory requirements.

- Focus on Customers: Building an MVP encourages a customer-centric approach. Banks can prioritize features based on actual customer needs and preferences rather than assumptions, leading to products that are more likely to succeed in the market.

A Step-Wise Guide To Developing MVP for Modern Banking

Whether you're aspiring to disrupt traditional banking, streamline investment processes, or introduce innovative payment solutions, understanding the key stages of fintech MVP development is essential. Here are the pivotal steps that you should consider to develop an effective MVP!

1. Market Research

Sometimes, ideas may not align with market demands. From the survey of CBInsights, the second reason for a startup’s failure was a ‘lack of market need’ (35%).

Therefore, prior to initiating an idea and commencing the MVP development process, it's essential for banks and financial institutions to adopt the customer-centric approach.

Start by conducting a thorough BFSI market analysis to understand customer needs, pain points, and existing solutions.

Then, engage with potential users, conduct interviews, and gather feedback to validate your assumptions and ensure your MVP aligns with their requirements.

2. Define Your Fintech MVP Goals & Objectives

Begin by narrowing down the MVP's focus to a specific area within the broader BFSI industry. Identify whether you aim to tackle payment solutions, lending platforms, personal finance management, etc. This focused strategy allows businesses to customise the MVP to effectively resolve specific challenges within that domain.

After identifying the focus area, determine the product’s unique value proposition. This could be offering faster payment processing, providing more accessible lending options, or any other innovative aspect that differentiates your product in the market. This step will establish a clear direction for the fintech MVP, helping banks differentiate themselves and attracting more target customers by addressing their specific pain points.

3. Map Out User Flow

An effective way to ensure a good user experience with the product's first iteration is by mapping out their journeys. In this stage, business analysts often work with designers on the user flow to guarantee no fundamental thing will be missed.

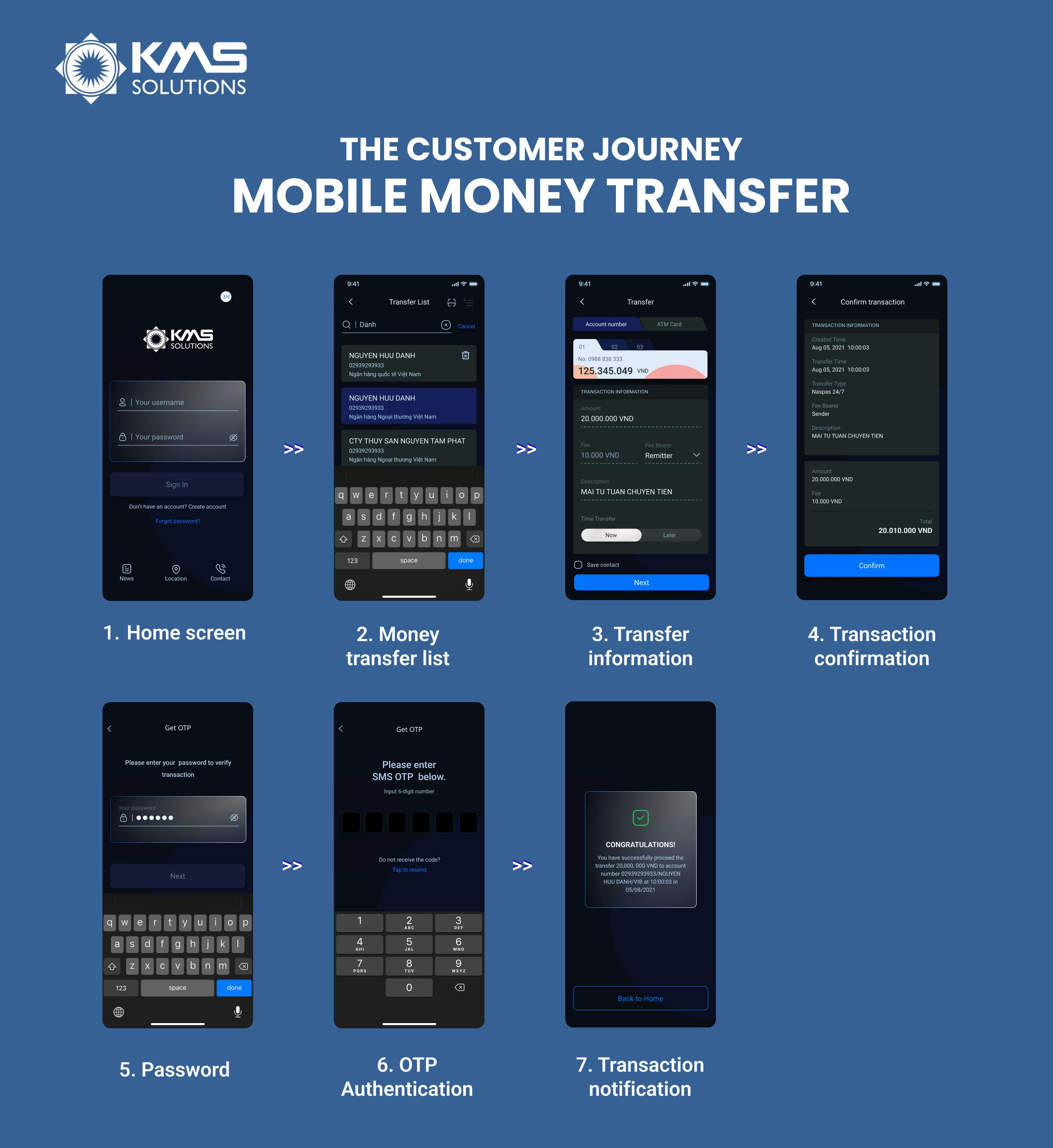

Thus, banks need to look at the app from the users’ perspective but not the developers’. This includes identifying the sequence of actions, decisions, and interactions a user will go through from the moment they access the MVP to completing a task. Here is an example of the user journey for transferring money within a mobile banking app.

4. Determine Key Features For the MVP of Fintech Products

In the dynamic BFSI landscape, identifying the key MVP's features demands a profound understanding of not only the financial intricacies but also the evolving needs and expectations of customers. To prioritize the MVP features, leverage the results from the market research phase and ask questions such as:

What do the users want?

What features do competitors offer, and how can your MVP differentiate itself?

Are there any technical limitations or dependencies that affect feature implementation?

For instance, if your MVP focuses on personal finance management, essential features could include:

Account management

Expense tracking

Budgeting tools

Goal setting

Financial insights.

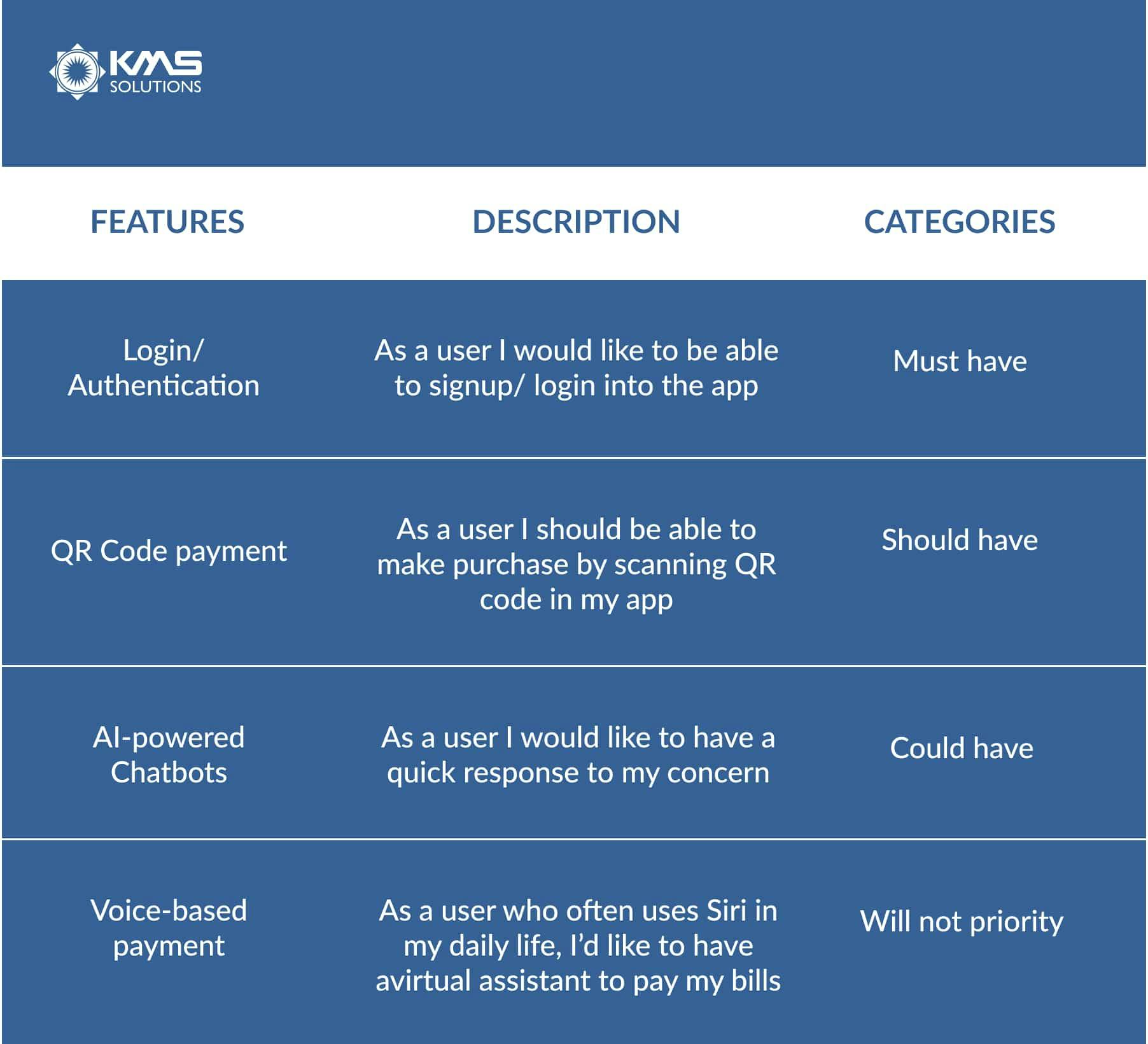

Among these features, you should categorize them based on high priority and low priority and arrange them in the product backlog (priority-wise). Here is an example of how you can categorize the features of MVP based on their significance:

5. Create a Technical Roadmap

Before moving to the development phase, banks and financial institutions need to consider the following criteria first:

- Technology stack: the chosen programming languages, frameworks, libraries, and tools should align with your product's objectives, scalability needs, and the technical expertise of your development team. Read Banking App Development: Best Tech Stack that You Should Consider for more insights on this.

- Data management: BFSI products typically deal with large volumes of data. To properly manage and analyse financial data, consider employing robust databases, data caching mechanisms, and data analytics tools.

- Integrations: determine whether the banking MVP needs to integrate with third-party services or APIs. Ensure that the technology stack supports seamless integrations and has a thriving ecosystem of compatible tools and libraries.

- Design for scalability and flexibility: When developing MVP in banking and finance, it is worth considering architectural patterns and design principles that allow scalability.

6. Build and Test the MVP

By adopting Agile methodologies, you can divide the development process into a smaller, more manageable process called “sprint”. This strategy allows you to concentrate on essential features and provide incremental value to users within shorter development cycles.

Keep in mind that the MVP isn't a lower-quality version of the final product; it still needs to meet security standards and fulfill the customer's needs. When moving to the next process, functional, performance, and security testing are vital to validate the reliability and effectiveness of your MVP.

Functional testing: verify that all features and functionalities work as intended

Performance testing: evaluate the system's responsiveness and scalability under different loads.

Security testing: helps define vulnerabilities and safeguard user data.

7. Launch and Scale the MVP Within the BFSI Industry

After launching the MVP, the BFSI company must get feedback from its clients on the release. The data collected will help generate new ideas, decide the strategies, and scale the product effectively to handle user growth.

The best practice here is leveraging cloud services and scalable infrastructure solutions. Cloud platforms offer the flexibility and scalability required to accommodate rising user demands.

How ACB Successfully Released a Mobile Banking MVP Within 4 Months

Due to the substantial rise in demand for digital and contactless payment solutions among Vietnamese users, Asia Commercial Bank (ACB) opted for a mobile-first approach. The bank engaged with KMS Solutions, a trusted technology service provider with domain knowledge and expertise in the BFSI sector.

Within only 4 months of collaboration, ACB could successfully release the MVP of the ACB Business App that incorporates different innovative banking features. Additionally, to help the bank ensure data security, KMS Solutions implemented top-tier security measures. This MVP version provided ACB's business clients with a convenient and user-friendly digital platform to access a range of banking services.

If you’re interested in the success story of ACB and the process through which we assisted the bank in achieving its objectives, read the full case study here: